Breathtaking Tips About How To Start An Investment Partnership

An investment company is a business entity that invests (instead of saves) people’s money in securities and financial instruments with the goal of earning a profit.

How to start an investment partnership. Clarifying your objectives will help you align your investment strategies. The first thing you need to do is find and organize potential members. Pick an investment strategy 5.

Firm organization.a private fund is more than just the fund itself. As part of the partnership, microsoft is investing €15 million in the french startup. Making a mistake once is understandable.

14 steps to start an investment company: Determine the purpose of your investment partnership. Start investing as early as possible 2.

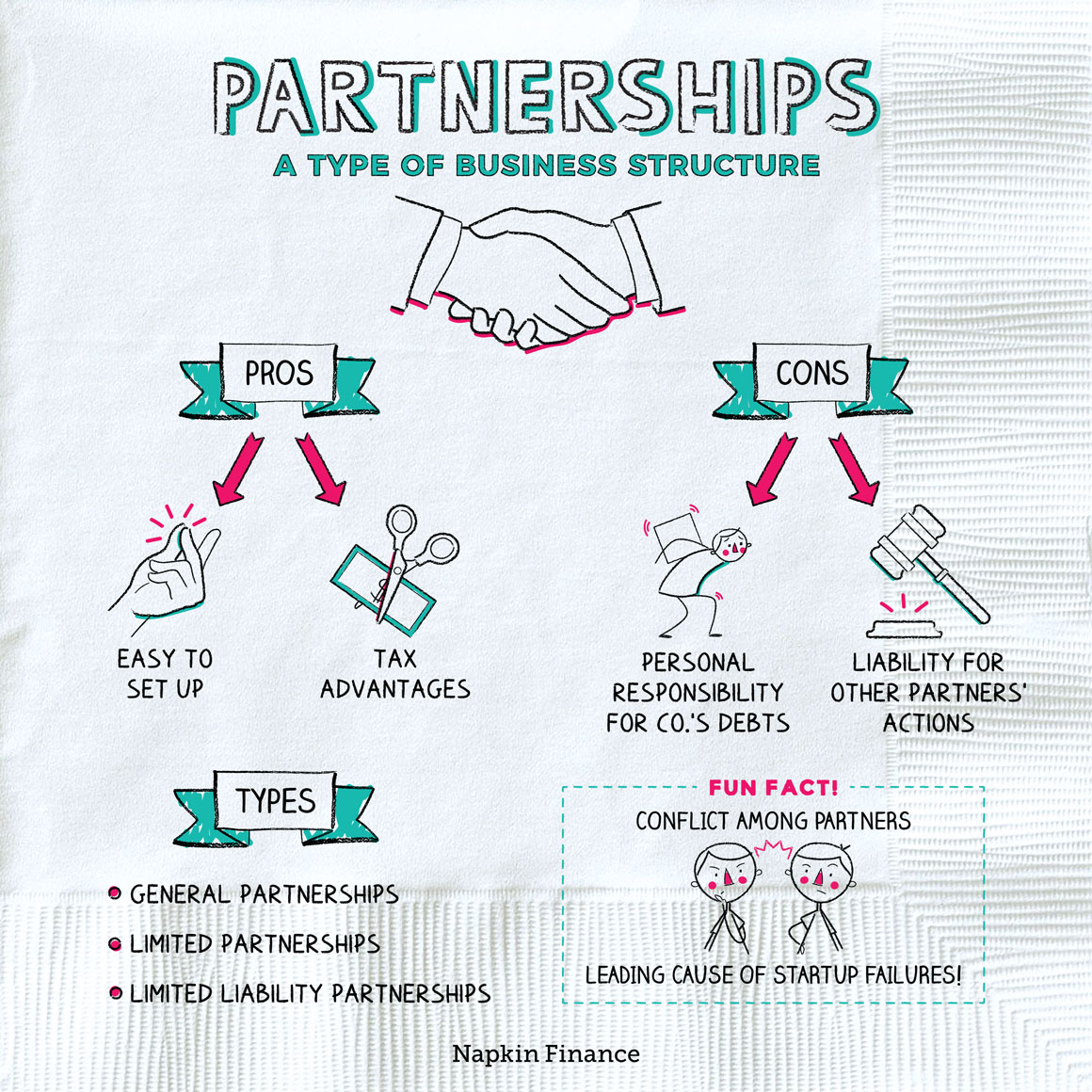

The term “investment partnership” refers to the type of business ownership where more than 90% of the business assets are held in the form of investments in. Financial support, mentorship, and career. On november 17th, openai’s board abruptly announced that co.

Starting a research faculty career is challenging, with barriers such as racism and sexism making it even harder. Develop your investment company business plan; The important thing is that each failure is viewed as a learning opportunity and a concerted effort is made to grow from it.

Find and organize potential members. The first step to starting an investment bank is to choose your business’ name. You can form a reip using the following steps.

Microsoft’s investment comes months after a rocky period for its main ai partner, openai. Steps to starting an investment partnership: Open an investment account 4.

To start an investment partnership, you need to set up a limited liability company (llc) with the partners. A group of people who pool their money to make investments. Choose the name for your investment bank.

Before forming a real estate investment partnership, it’s a good idea to involve a trusted professional who is familiar. Investment adviser considerations. Usually, investment clubs are organized as partnerships and after the.

The fund may have a separate investment adviser that provides. This may seem like a daunting task, but it's. When it comes to finding the right startup investment partners, the first step is defining your ideal investment partner.