Glory Info About How To Manage Household Budget

Slash spending, boost savings and pay off debt by creating a realistic budget.

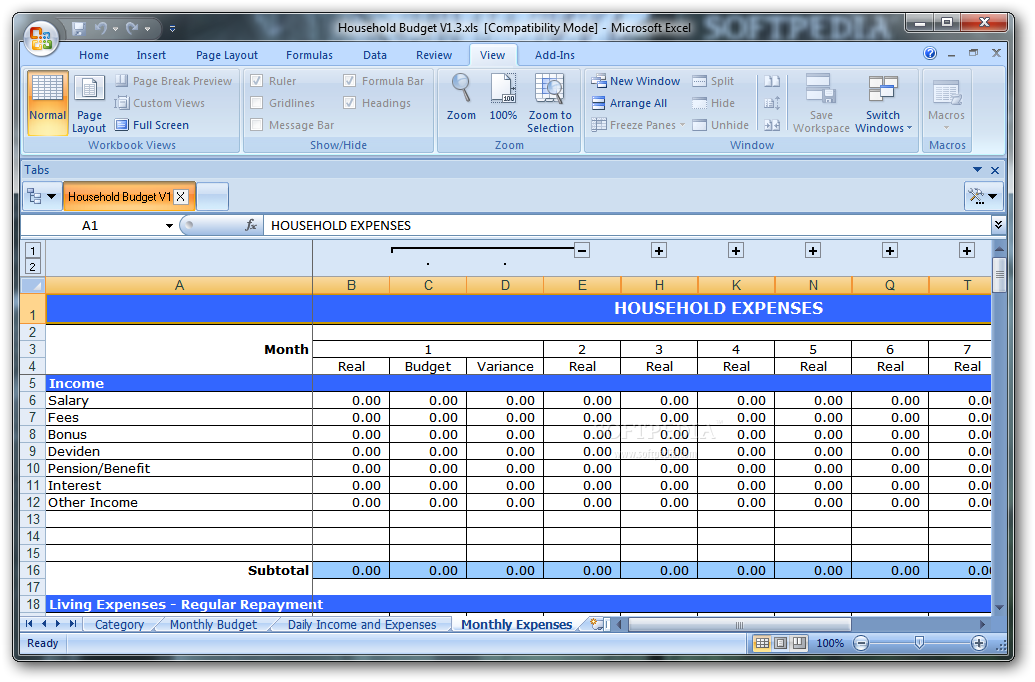

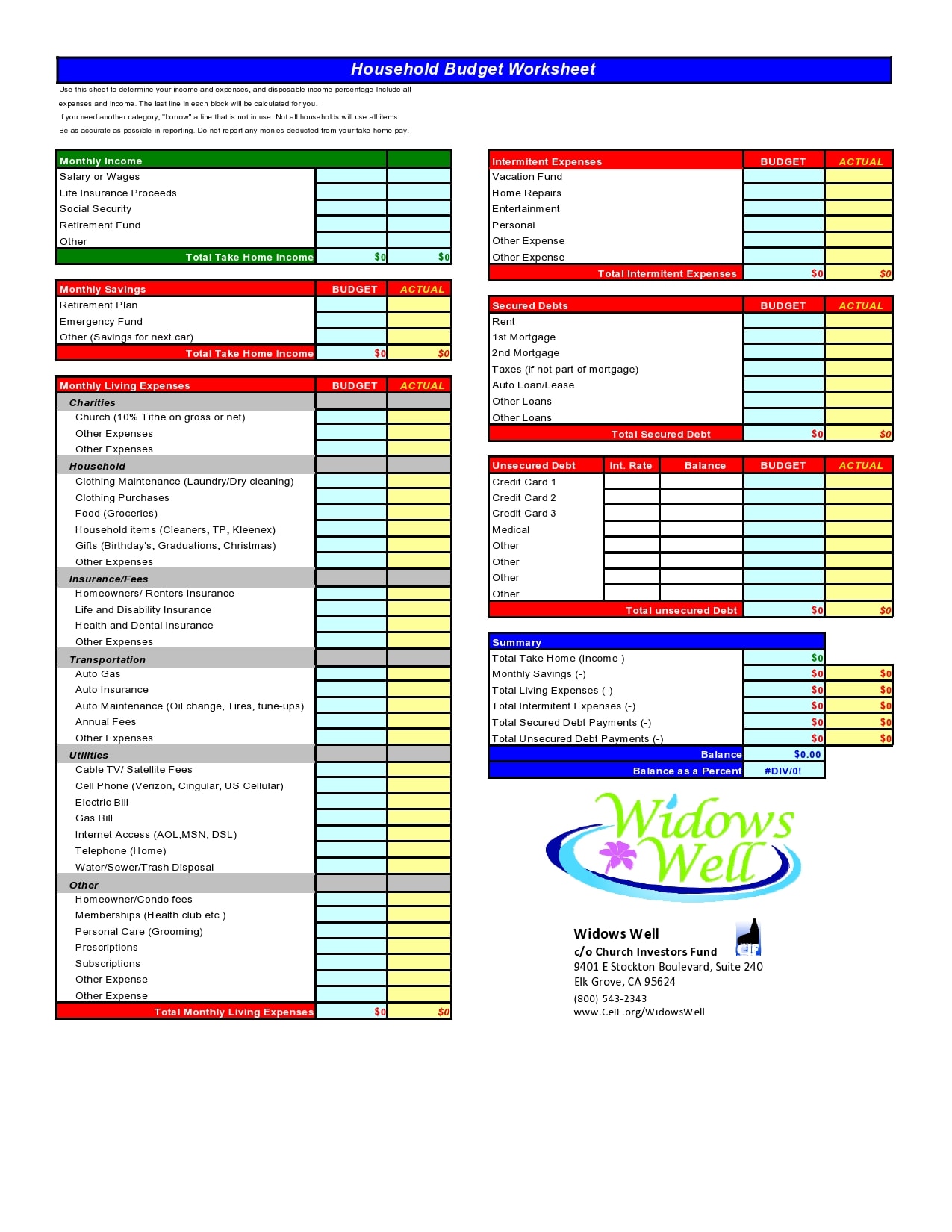

How to manage household budget. How to create and maintain a family budget. Gather bank statements, household bills and receipts. List all the fixed expenses and the amount of the expense.

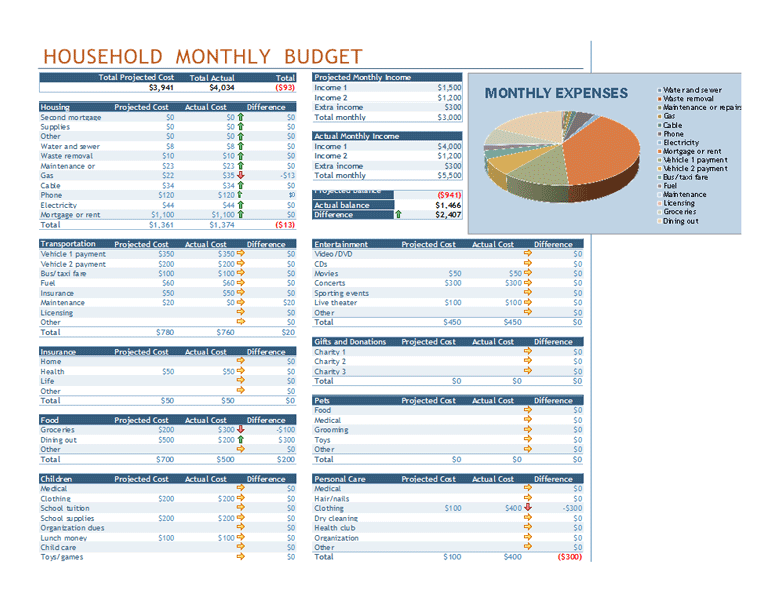

Having a budget helps you see where your money is going. Add all sources of income for. Some of your monthly expensesare fixed—mortgage/rent, property taxes, child support, and alimony—while others may vary, such as electricity, water, and groceries.

List your expenses and streams of income. Why should you have a family budget? Calculate your monthly income, pick a budgeting method and monitor your progress.

Tips for creating a family budget that works (for everyone) what is a. Identify exactly where you want to be in 6 months, 1 year, 5 years, and beyond. A good budget helps you reach your spending and savings goals.

Whether you are struggling to make ends meet, wanting to pay off debt or saving for the future, drawing up a family budget is the best way to manage your. The house in december passed a 10%. You should also manage your home budget by recording sources of income.

Learn how to create a household. The first step to creating a monthly budget is understanding how you manage your money from day to day. Easy steps to plan and manage how you spend your money.

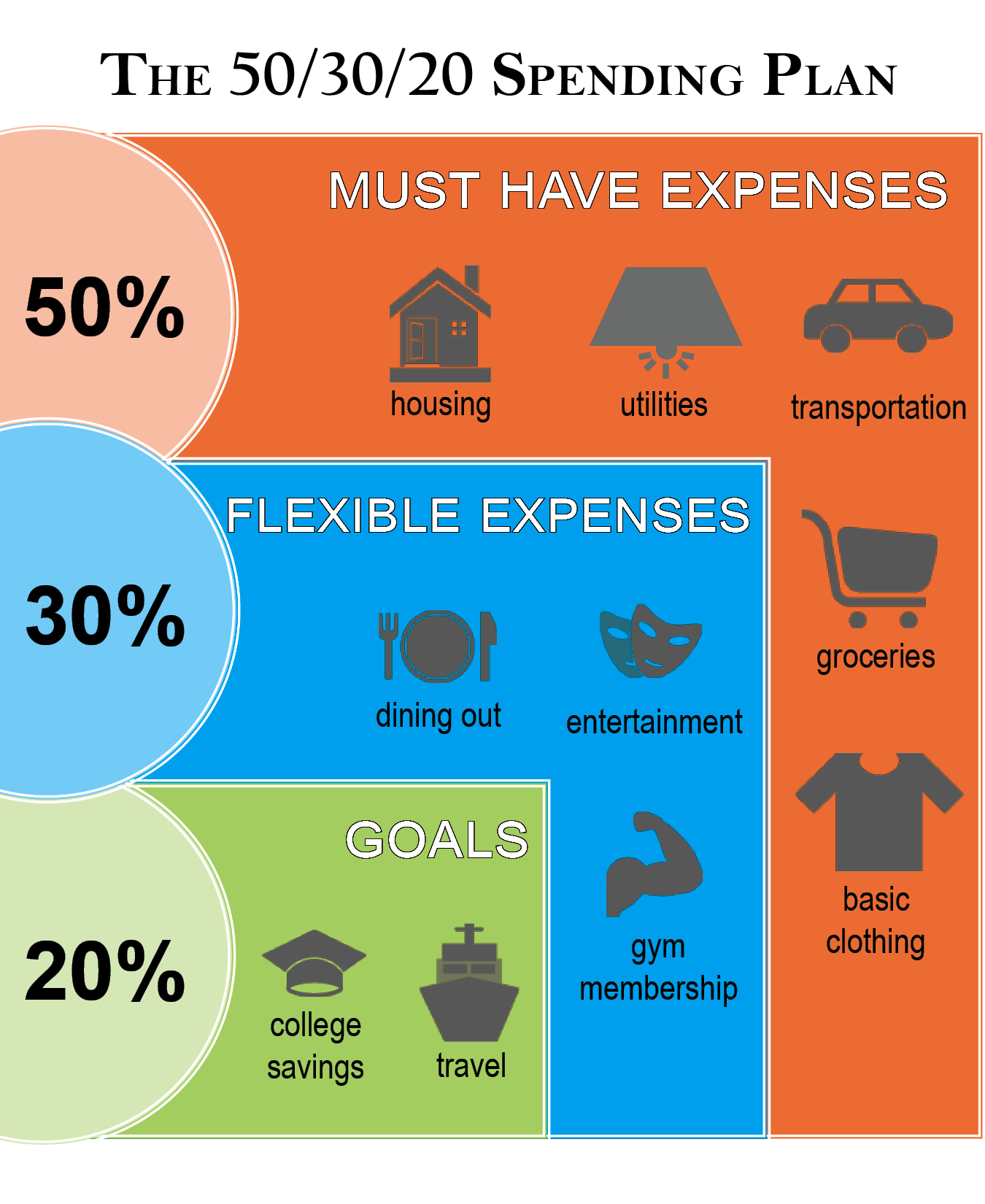

Nerdwallet recommends the 50/30/20 budget, which suggests that 50% of your income goes toward needs, 30% toward wants and 20% toward savings and debt. How to do a budget. Try the 50/30/20 rule as a simple budgeting.

From april, those earning between £75,000 and £125,140 in scotland will. Draw up a budget you. It helps you map your income and expenses, giving you a clear.

Start by tracking your income and. Updated june 26, 2023. How to set up your family budget in 3 steps.

Here are 7 compelling reasons why a household budget is essential: A budget is like a gps for your money. This includes, for example, income from employment, business or real estate.