Amazing Info About How To Get A Deed In Lieu Of Foreclosure

Your credit may be less damaged.

How to get a deed in lieu of foreclosure. A deed in lieu of foreclosure is a legal agreement where a homeowner/borrower gives the legal title of their home to their lender. It is possible that the. Avoiding the negative impact of foreclosure on credit:

Obtaining a deed in lieu of foreclosure isn't as simple as just requesting one. A foreclosure can significantly harm a homeowner’s credit score and make it difficult to secure future. For the homeowner, there are several advantages of getting a deed in lieu of foreclosure.

Foreclosure counsel requests scheduling of a mandatory settlement conference required by cplr 3408. One such option is “deed in lieu of foreclosure,” a unique solution that may offer respite for those facing insurmountable mortgage debts. A deed in lieu of foreclosure can stop all foreclosure proceedings.

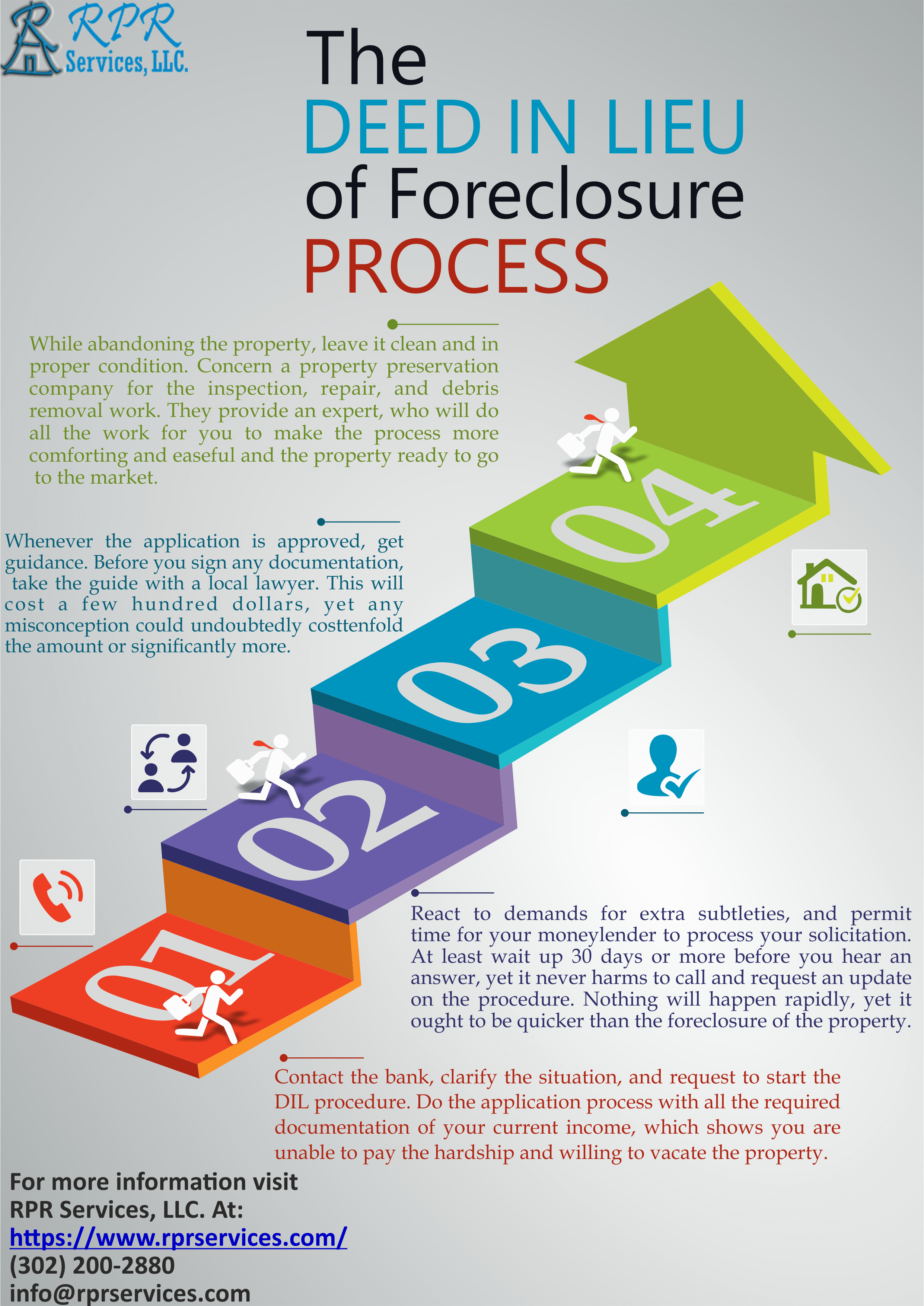

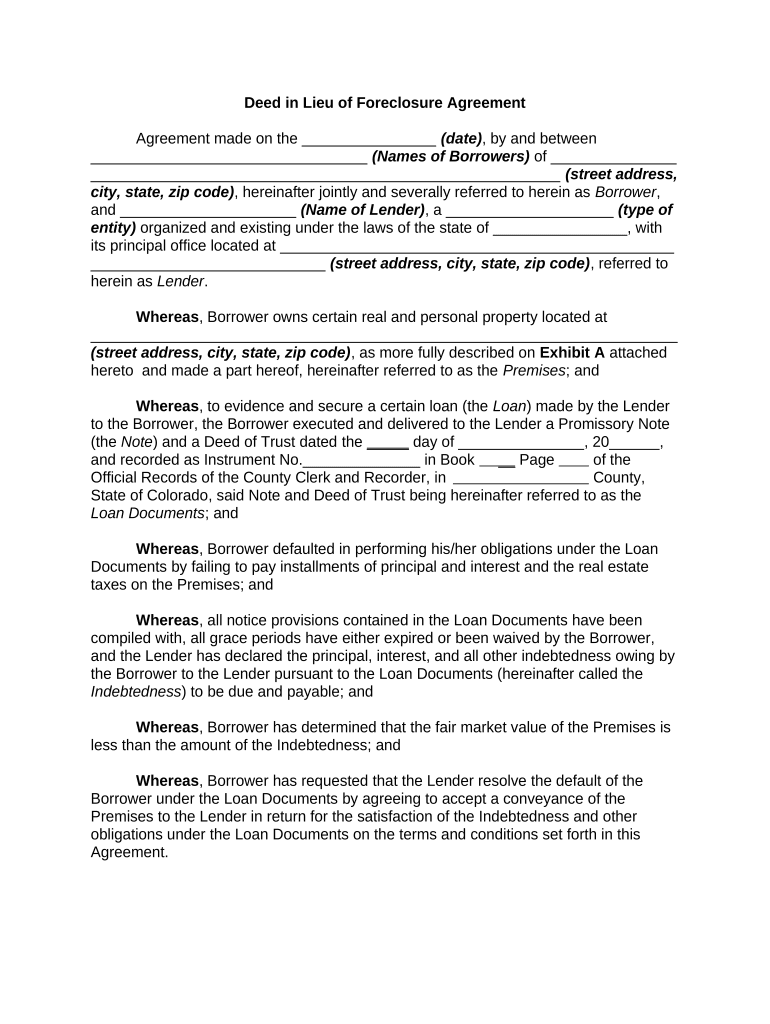

While a deed in lieu of foreclosure may still show on. Instead, you and your loan servicer must agree to it. The first step in obtaining a deed in lieu is for the borrower to request a loss mitigation package from the loan servicer (the company that manages the loan account).

Generally, a bank will accept a deed in lieu of foreclosure only if there are no other liens on the property, such as a second mortgage, mechanic’s lien, tax lien, etc. Most of the time, the lender offers it in the preliminary stages of the foreclosure process to. The deed in lieu of foreclosure can be offered by either the lender or the borrower.

In a deed in lieu transaction, a homeowner who's facing a foreclosure gives up all legal rights to the home in exchange for getting out of having to comply with the loan. Branson edited by cliff auerswald 66 comments my mom procured a reverse mortgage when property values were high. Foreclosure counsel requires the homeowner to.

What is a deed in lieu of foreclosure? Homeowners who decide not to put up a fight to keep their home or to stave off foreclosure can instead pursue a deed in lieu. While the exact process varies by lender, here are the basic steps:

A deed in lieu of foreclosure is a contract between a lender and a borrower where the. September 19, 2022 by michael g. Sample frequently asked questions what is a deed in lieu of foreclosure?

A deed in lieu of foreclosure is a process that can be started when you no longer want to keep yo. Contact your mortgage servicer — the company you send your mortgage payments to each month — to explain. A deed in lieu of foreclosure will impact your credit history for four years.