Fine Beautiful Info About How To Claim Family Tax Benefit B

As a single parent, you may be able to claim the parenting payment.

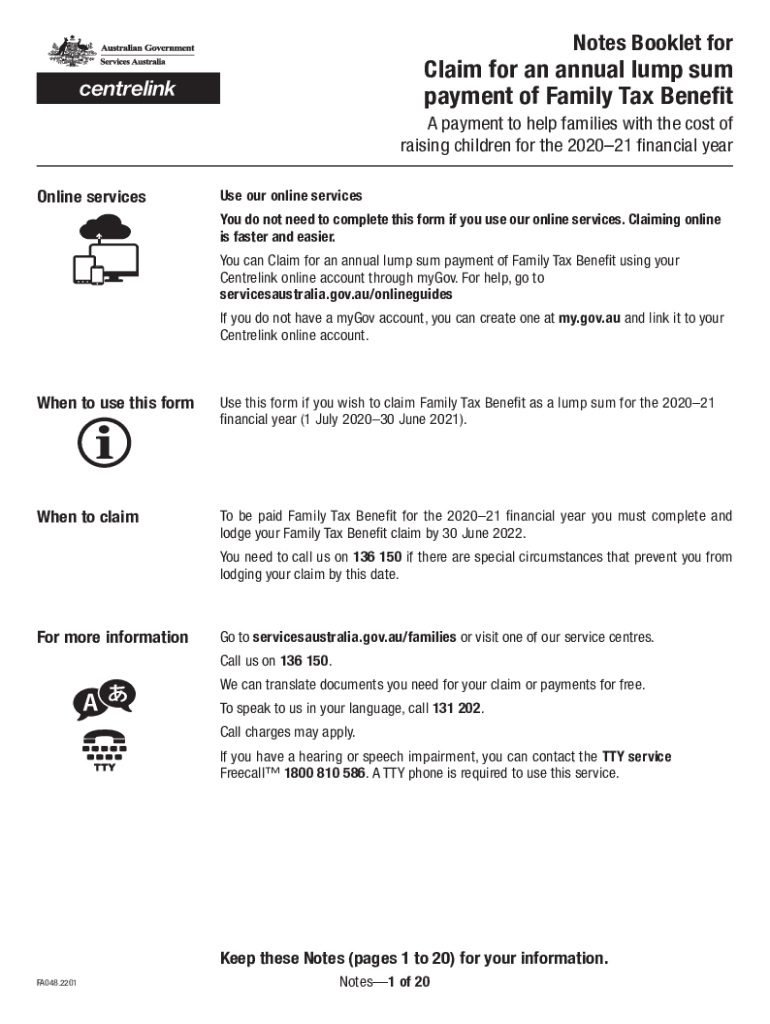

How to claim family tax benefit b. The family tax benefit is separated into two parts. Family tax benefit is paid through centrelink, so you will need to either lodge a claim to centrelink online via your mygov account or attend a centrelink service. Part a — a payment.

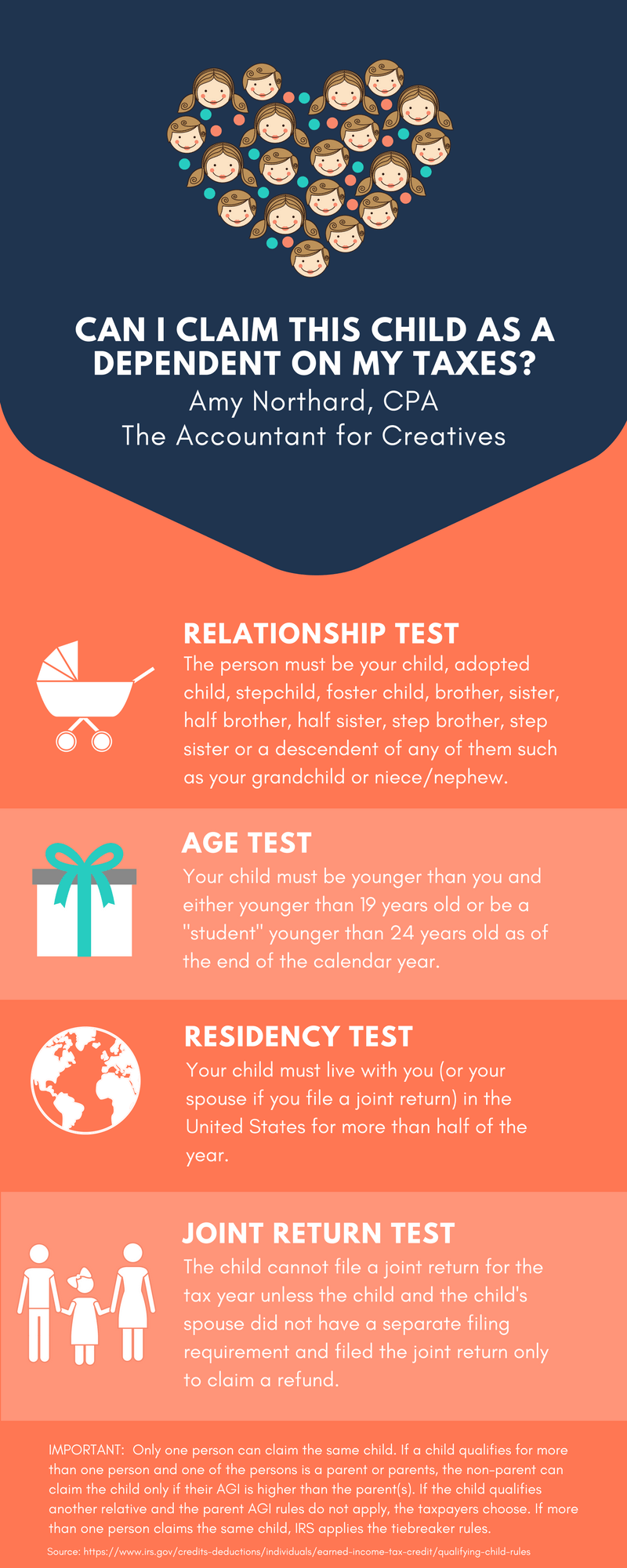

Have a dependent child or full time secondary student aged 16 to. Residence rules, and care for the child at least 35% of the time. What are the rates for the family tax benefit part a and family tax benefit part b in 2022?

What is the family tax benefit? You must tell us if your circumstances. We’ll tell you if you need to.

To get this you must: To qualify for family tax benefit you must meet the following: Select apply for family assistance payments (including paid parental leave) then follow the prompts to complete your claim.

The easiest way to make a claim is online via your mygov account. There are things you need to do to manage your family tax benefit (ftb) payment. You’ll need a mygov account linked to centrelink to begin your application.

Raising kids growing up top payments family tax benefit what can affect your payment what can affect your payment the amount of family tax benefit you get will depend on. You could also be eligible to claim family tax benefit part b. Family tax benefit part b calculator.

You can find a handy calculator for family tax benefit part b. Read on to learn more about the family tax benefit and how to make a claim. Select make a claim or view claim status, then make a claim.

You may also be eligible for other payments listed on this page, including: Your options and obligations for family tax benefit. We pay family tax benefit (ftb) part b per family.

34 share 14k views 9 years ago this video is a quick way to learn how to claim family tax benefit. We work out your payment rate using your adjusted taxable income and an income test. The first step to claiming the family tax benefit is to set up your online accounts.

You can lodge a claim for family tax benefit (ftb) any time, including up to three months. If you share caring responsibilities for. Find out about eligibility and how to claim.